Blog

Seven Faces of Philanthropy

One of my (many) online vendors just advised me that October is National Book Month. Since I read a book in some form nearly every day, that makes me happy. And having just returned from the national Charitable Gift Planners conference in Indianapolis, I was also happy to hear one of the speakers promote a professional book I’ve loved for more than three decades: The Seven Faces of Philanthropy.

When it came out in 1994, it was one of the first published research pieces in our industry. Russ Alan Prince and Karen Maru File had interviewed 100(?) major donors about their motivations for philanthropic giving. Thirty years later we have so much research and so many resources: the Lilly School, Dr. Russell James, US Bank’s HNW study every two years, and on and on.

But three decades ago, taking a formalized peek into the mind of a major donor was novel. And three recessions and one pandemic later, I still find their findings valid. After all, the zeroes may get larger, but people are basically the same.

You probably know this, but the research categorized the donors as Communitarians, Investors, the Devout, Socialites, Altruists, Repayers, and Dynasts. I still try to categorize the donors for my clients into those categories to help frame the conversations. Communitarians and Repayers are still my favorites. And I still have to psych myself for Socialites and Investors. Sigh. Four decades in the business still hasn’t made me care much about events or the actual ROI of a direct mail piece.

I’m pretty sure The Seven Faces of Philanthropy is still in print. If not, I’m sure the used book vendors will have copies. Whether you’re encountering the Seven Faces for the first time or reacquainting yourself with an old friend, it’s always a good idea to pick it up for a quick look before a major donor call. I recommend celebrating National Book Month with a dip into an old favorite, The Seven Faces of Philanthropy.

Haunted by a Storage Unit

Storage units. I have one non-professional goal this year and that is to get rid of my storage unit. When we moved from a house in Northern Arizona to an apartment in central Phoenix, we downsized—but not enough. I swore we wouldn’t have a storage unit. And I swore when the garage was too full to park a car. So we got one. And I largely ignored the inherited stuff, my Longaberger baskets, overflow kitchen items, and holiday decorations that filled it.

Things were rocking along well until January. My storage unit costs increased 25%! No warning. No rationale. Just a higher bill. That got me on a rampage and we have been whittling away at contents since then. My two clients with thrift stores—the Humane Society of Sedona and Verde Valley Sanctuary—both received some of the overflow. But we’re not there yet.

Now my sister is coming in June and I am determined that the storage unit will be emptied, and I’ll be $277.17 richer a month. By the end of June. So I have a goal and a time frame. And you are reading this wondering what does that have to do with fundraising?

A storage unit is where stuff goes you don’t want to look at, don’t want to deal with, can’t quite get rid of but aren’t really using. How might that apply to your nonprofit work life?

In the nonprofit world, you are never not busy. There is no such thing as down time. That makes procrastination easy for some project you’ve been putting off because it’s too complex or too time consuming. Because you ARE busy. And no one can fault what you’re doing. But you know. Your conscience nags you about the gift accept polices you haven’t reviewed for five years; that strategic plan that is supposed to be guiding forward motion; those old files you promised yourself to review to see if those donors are even alive. Every one of us has a bottom drawer somewhere of something important to our mission that we have avoided – like my storage unit!

I don’t know what your impetus will be. There probably won’t be a 25% cost increase for something you should be doing. At least I hope not. Maybe you’ll just put it on your calendar to deal with that bottom drawer—or one thing in that bottom drawer—and get it off your worry list.

And, just as a self-promotional aside – if that strategic plan you’ve been avoiding says it’s time for you to be building endowment through a planned giving program, I can make that one easy for you. My ebook The 72-Hour Planned Giving Starter Program is now available on Amazon. And I have print copies available, too.

Feel free to check back with me in June about my storage unit progress. I am determined. It WILL be empty.

Charitable Tax Deductions Matter

Heading into a weekend where it’s mostly tax prep on the agenda, I’ve been thinking about taxes and Congress – and getting almost as excited about those thoughts as I am about this weekend. As in, NOT.

First, let’s talk taxes and charitable giving. Maybe it’s because so much of my work is in the planned giving arena that I have found tax considerations to be an important motivator for donors. When donors are giving away assets – which is usually what funds planned gifts – I promise you, there is significant consideration about how taxes come into play with the gift.

If it’s a really large gift, the major purpose may be to avoid estate tax. Additionally, a current charitable income tax deduction is likely to be in play because those who are making really large charitable gifts are among the 9% of Americans who still itemize. Further, depending upon the funding asset, if it’s an appreciated asset, there may also be avoidance of capital gains tax.

So, yes, in my world, taxes are a major consideration on how and when a large charitable contribution is made.

But what about the 91% of Americans who no longer itemize their taxes since the Tax Cuts and Jobs Act took effect in 2018? I have always been skeptical of the oft-repeated mantra in the nonprofit world that people aren’t motivated to give by a tax deduction. This fiction has been spouted for most of my 40+ year career in nonprofits. I didn’t believe it in 1983 and I don’t believe it in 2025.

First, let’s look at where this fiction comes from. It comes from donors who are self-reporting. In survey after survey, tax motivations come in no higher than the middle, and usually near the end, of giving motivations as identified by donors. And for more than 40 years I have cried, foul!

For a couple of years after the TCJA took effect, Congress allowed an above-the-line $300 charitable deduction. The first year, it was $300 period. The second year, it went up to $600 in households filing marital jointly. Every year since that deduction expired, our industry’s lobbyists have urged Congress to renew it. No dice. But if we really believed that tax deductions don’t factor into decisions to give, why would we care?

The evidence that tax deductions matter is everywhere. The wealthiest donors are still giving and giving more. Of course they are. Their top income tax rate was reduced to 37%. The stock market has been generally on a multi-year run-up. The rich are richer.

But nonprofits everywhere are seeing huge reductions in $100 and under donors.

Inflation certainly matters. Even when dollars reported are up, when inflation is factored in, we find out that the spending power of those dollars is actually down. Whether it’s Giving USA’s annual report or The Philanthropic Landscape from CCS, that message comes through.

But a charitable income tax deduction is important. Maybe it’s just the perception that the gift matters enough to be worthy of a deduction. Or maybe giving is deemed to be patriotic and validated by the government. I don’t know why a charitable income tax deduction matters, but I know it does. For the health of our nonprofits, I hope Congress restores it in some fashion.

Meanwhile, this weekend, I’ll sort out my charitable deductions and put them alongside the medical deductions I can’t claim either. I’ll hope that I stay healthy enough never to have to worry about a medical deduction, and that someday, Congress restores the charitable income tax deduction. It does matter.

What will 2025 bring?

It’s always interesting to start a new year. One organization I work with sent out a series of year-end emails from December 26 through 31. The emails were excellent and they gave opportunities besides giving – newsletter sign up, website links. I don’t know about click throughs, but the giving response, at least, was crickets. Admittedly, this is a new organization with a tiny email list and a very small donor base. But still.

Another organization, however, with a year-end match, blew through their goal and more than met their match. Of course, they are well established with a robust email contingent.

What do those two examples tell us for 2025? The answer is...not much. There are too many possibilities to call it. Did the young organization get no gift response because they haven’t made it to people’s year-end giving list? Had their donors already made their gifts for the year and weren’t going to make a subsequent one? Or was it some other unknown factor?

Did the venerable organization exceed their goal because of the match? Because they have lots of donors? Because many of their donors are accustomed to giving at year-end? Or is it their mission? Or some other variable?

Ones head could spin a la The Exorcist just trying to use these two examples to look into the future. It makes me wish Madame Judio and her crystal ball actually existed. National indicators before year end were full of doom and gloom – fewer donors/fewer dollars/fewer volunteers . . . . I continue to believe, however, that worthy nonprofits will beat the odds. I just don’t want to see the kind of bloodbath we saw in 2008 when the economy tanked and so many nonprofits didn’t make it. Not that I’m in any way predicting the economy’s tanking.

So to continue moving forward to create financial stability in support of your mission, I offer these recommendations:

- Steward your donors. Please take care of those who are already supporting your mission. Make sure their email address is current. Surprise a donor with a thank you call on the anniversary of their first gift or when they’ve made ten gifts or when they’ve supported you for five years. Come up with your own benchmarks. If you call 10 donors a month, that will be 120 donors you wouldn’t otherwise have talked to.

- Keep your website up to date and easy to use. I realize that is probably not your department, but if links are broken, if your QCD information doesn’t reflect 2025 numbers, if there are six clicks needed to make an online gift – enlist whatever help is necessary to get it fixed.

- Think beyond unrestricted giving. I understand all the reasons why your ED and CFO want unrestricted gifts. But if you allow donors to support a favorite program or a specific component of your mission, you open the door to donors who aren’t responding to generic giving opportunities. Start small. Pick two areas to promote and see if you can attract some new support.

- Think easy asset gifts. Yes, the axiom says “cash is king” but in the nonprofit world, the real royalty are assets. Again, start small. Begin the year by inviting your donors who are at least 70.5 years old and have a traditional IRA to make a Qualified Charitable Contribution to your organization. Learn why that can be an advantage for your donors. Ask your donors to name you as beneficiary of a life insurance policy or their IRA or a brokerage account. Such gifts cost them nothing and leave them in control of the asset as long as they live. And finally, have a board member connect you with their broker and set up an account that will let you accept gifts of appreciated securities. Do this one last because most stock is given at the end of the year, so it’s less pressing than the other opportunities.

So the answer to the question in the title, “What will 2025 bring?” is right up there with why is there air? Actually, some physicist could probably answer the latter. But I can’t answer my own question with anything other than these injunctions. If you take care of your donors, make information and online giving easily available, open up the possibility of a couple of restricted giving options, and embrace easy asset gifts, Madame Judio predicts your 2025 giving year will be a good one.

Go do good work for 2025!

November 2024

As the giving season gathers steam for my clients, it frees up time for me. On my side of the table, there’s a little time to exhale. That never-ending “to do” list will shorten a bit for me during the rest of this calendar year. It’s also a perfect time to plan for the coming calendar year if staff can escape from the press of year-end giving duties long enough to look ahead.

In a way, National Philanthropy Day celebrated earlier this month, kicks off the giving season. Did you know that studies indicate that most nonprofits will receive close to one-third of their total annual revenue in the last six weeks of the calendar year? The last week of December—and especially the last three days—is critical for online giving.

But of course, it all starts with Giving Tuesday right after Thanksgiving. Expect to be flooded with emails—and many charitable options—on December 2nd. By then, most nonprofits will have their year-end mailers out and will start following up with those donors who typically give at calendar year-end.

Those donors who make charitable gifts of stock will need to meet those deadlines earlier than the last week, most likely, in order to assure transfer before the calendar page flips. And anyone who still needs to make a gift from their IRA with a Qualified Charitable Distribution should be talking NOW with their IRA custodian to make sure the funds transfer directly to the nonprofit in December.

But many will make their gifts online late in December and have the contribution validated by return email. And that’s fine, too. It all adds up.

This calendar year-end may be especially interesting in light of the doom-and-gloom trends we keep reading about in the nonprofit world. GivingUSA reported a 2.1% inflation-adjusted decline in giving for 2023 (from 2022). The percentage decline is perhaps not so worrisome as that smaller gifts seems to be declining at a faster rate than larger gifts. Those small annual gifts often grow into sustainable major gifts over a few years. Losing the bottom of the giving chart is certainly problematic.

The US has gone from being a nation of givers, to a nation where fewer than half of households now make any charitable contributions. The decline in this century alone has been significant – 20%! It’s not hard to understand why. Every time megadonors make bazillion dollar gifts, it makes headlines. I’m guessing it also makes small donors consider whether their own $100 might be unneeded. Then, we’ve had two recessions in this century – one early and the Great Recession of 2008-9. Then the tax code changed in 2017 which may have discouraged those who no longer itemize deductions from making a gift. Then we had a pandemic, which in many facets of life is still affecting us.

There will be some early indicators about 2024. I suspect the Fundraising Effectiveness Project will have some news for us in the spring. And, of course, in June, we’ll have the report from GivingUSA. Nonprofit professionals everywhere are working hard to support their mission through philanthropy.

I trust this giving season will be fruitful and abundant and that everyone who can will make generous and thoughtful charitable contributions. I wish you a Happy Thanksgiving and a wonderful holiday season!

National Estate Planning Awareness Week is October 21 – 27

It’s a good time for it. It follows the brand new Donor Advised Fund Giving Day; comes before families gather for the holidays; and precedes Giving Tuesday. And maybe most important right now, is that it puts us into the 15-month countdown for big estate planning changes that will come at the end of 2025. Awareness is good – and we often need that nudge.

The thing about estate planning is that it’s easy to put off. If you are doing income tax planning, you have deadlines. Even if you file for an extension, sooner or later you have to pay your taxes. And the time for deductions doesn’t accrue, just the amount of time you have to pay.

So about estate planning. This is a good time to be thinking about it. Those with financial advisors and large estates have probably been hearing for a long time about the need to get assets out of their estates before the estate tax limits revert to $5 million plus inflation in 2026.

For the rest of us...well, we’re not getting any younger. Planning doesn’t just happen. We have to make an effort. We need to find and agree to delegate someone to pay our final bills and manage the distribution of our estate when we’re gone.

And doing estate planning forces us to compile and update information. Are there old policies hiding in a desk drawer or safety deposit box? Who is going to get Grandmother’s jewelry? Is your deceased parent still the named beneficiary on an old account? Did you ever close that account at xxxx? What about passwords? If you pay your bills online can your personal representative take care of that for you easily? Do you want your Facebook page to go on forever?

Estate planning takes some effort, and Fall—often the time for new beginnings – is as good a time as any to begin putting your affairs in order. If your Fall is already full and hectic, make a note on your calendar for January when things slow down and resolve to do some of your own estate planning before 2025 is gone. You’ll be glad you did.

DAF Giving Day is October 10

GivingUSA tells us that giving from Donor Advised Funds (DAFs) in 2022 totaled $52 billion – or ten percent of all charitable giving. Now in the spirit of individual state giving days and Giving Tuesday, a DAF payment processor has deemed October 10 “DAF Giving Day.”

Like most giving days, I imagine it will start slowly and grow over time. Still the publicity surrounding the event may lead some DAF account holders to recommend grants from their individual DAFs—regardless of how the payments are processed. And—despite the commercial impetus—it’s a good thing for nonprofits when DAFs send money to support mission.

So, if you have a DAF, I encourage you to assess your philanthropic aims for this year and determine if there is a special nonprofit who could benefit from a distribution from your DAF. There are so many opportunities to give that I’m sure there is some nonprofit who would benefit from your recommendation.

And if you don’t yet have a DAF, you might want to think about the ease of giving from a DAF. My first recommendation would be to look at your local community or religious foundation. Because of their extensive knowledge of the nonprofit landscape, they can help with your philanthropic aims and education. Services and recommendations from your community or religious foundation are usually free. If you already know where you want to give, the impersonal but efficient services of a commercial DAF holder may meet your needs.

Donor Advised Funds, in my opinion, have received some unfortunate and probably unfair legislate scrutiny. Yes, donors to DAFs qualify for an income tax deduction when they put money into their DAF. Yes, they can let the DAF grow to help fund a special project without making a forced distribution. Yes, DAF donors can request an anonymous distribution from their DAF.

The only reason this “seems” to be a problem to some legislators, is that DAF rules vary from private foundation rules. But a DAF isn’t a private foundation. It is part of a public charity. DAF holders—both at community and religious foundations and commercial DAFs—make more distributions than the minimum 5% required of public charities. In fact, some of those private foundations meet their minimum 5% rule by sending money to a DAF at year end. But I digress.

DAFs are a smart way for donors to organize their philanthropy. They are a useful charitable tool. If you would like more information on starting your own Donor Advised Fund, reach out to any of the more than 1,000 DAF sponsors in this country and learn more. And consider being among the first DAF holders to participate in DAF Giving Day on October 10.

It's not too late—but almost...

I just read the M&R Benchmarks study on giving in 2023. There were lots of takeaways, but this statement really hit home: December giving made up 26% of all online revenue, and 34% of one-time online revenue. Donations made on December 31 accounted for 5% of 2023 revenue.

The only thing this statement didn’t tell me that I wanted to know was how much of total revenue for the year arrived in the month of December. However, in another study with Neon One, total December giving was tabbed at 26% of the annual total—not just online giving. And an additional 16% of the yearly total came in November.

Most of my clients come to me for some aspect of planned giving. But planned gifts exist as part of a continuum and, in almost all cases, are the culmination of a long and rewarding relationship with a nonprofit. Planned gifts usually start in the annual fund. With that in mind, I’m always sticking my nose into the annual fund. And I’m about to do it again, right here; right now.

While I want your development plan for the year fleshed out ahead of the start of the year, if you haven’t done that, spend some time this summer—as in now—strategically laying out your plans for fall, for Giving Tuesday and for your year-end giving campaign. Ideally, they would all be thematically aligned.

Think about the tools you have for your campaign. Are you publishing an online or print newsletter this fall? An annual report? Do you have an event where you can speak and/or distribute literature with a friendly QR code or just ask them to text to give? Make opportunities for donor education—seminars, eblasts, even social media posts where you recognize a donor who has made a QCD and link them to your website for information about making their own QCD.

Here's a simple outline—and by no means an exhaustive list—of things you might do in the last four months of the calendar year to create your own banner:

September

• Article reminding of QCD opportunities

• Recognition of donors on social media with links to website info

• Annual report which includes financials; smart ways to give; recognizes donors who have made interesting gifts; lists major and legacy donors who have given permission to be listed

October

• Article introducing year-end theme; goal of funding; match, if any; ways to give.

• Recognition on social media of match provider donors and reiteration of goal.

• Prepare direct mail – if any -- to arrive no later than November 15. Many families decide their year-end gifts over Thanksgiving and if they are traveling for the holiday, need that info in hand before the trip.

• Recognition on social media of QCD donors with link to website info

• Special personalized, individual requests to those who give in November and December to consider giving again. Be sure to reference how they usually make their gift – DAF, stock, check; tell them how much they gave last year; tell them the impact of that gift; and ask them to consider a slightly larger gift this year if possible.

◦ This is a great time for Board members to exercise their personal contacts in support of this endeavor.

• Enclose buck slips in gift acknowledgments about year-end gift opportunities.

November

• Article about how to make a gift of stock and advantages of doing; even better if featuring a donor who has done so.

• Alert board members who made personal contact requests when gifts come in and ask them to call their donor with thanks. You may need to script the call and/or a voice message.

• Heavy social media and eblast promotion of Giving Tuesday effort/year-end match

• Holiday cards with personal messages if sending them

• Specialized pre-programmed emails for Friday, Saturday, Sunday and Monday after Thanksgiving leading up to Giving Tuesday.

• Wednesday after Giving Tuesday, social media notice and eblast of thanks with Giving Tuesday total, amount remaining to goal, easy links for ways to give.

• Enclose buck slips in gift acknowledgments about year-end gift opportunities.

December

• Individualized follow-up with October personalized solicitation to see if they require any additional information and if you can help.

• At least weekly postings on social media on progress to goal and what you have already been able to accomplish or commit to because of early gift commitments

• Reminders of deadlines, office closings, holiday emergency contacts, etc.

• Continuation of board thank you’s to their special request donors

• If you do any traditional media advertising in print or on radio – even Google ads – put your money into December.

• The entire last week of the year is critical with 13% of the entire yearly total coming in the last week of December. Prepare a specialized pre-programmed eblast request for an online gift daily from December 26 through December 31.

• “There’s still time to make a 2024 gift” buck slips enclose in all outgoing mail.

These are just a few of the things you might do to take advantage of the year-end generosity schedule Americans are used to. I hope you have your own plans in place and are following them. But if not, feel free to adopt any or all of these techniques that work for you.

Regardless of your plan, it’s vital that your website makes it easy to give without too many clicks. Make sure you keep your constituents updated daily about progress to goal. The last week of the year is critical – even the last day. Don’t miss that opportunity. And good luck with your year-end giving this year!

Judi

Pay Attention To Your Mid-Level Donors

This month I want to talk about the mid-level donor. I’ve been doing lots of thinking about them because I’m talking about them quite a bit this month and next—In St. Louis and in Denver and in Pittsburgh.

What is a mid-level donor, you might ask? The study that prompted my thoughts focused on donors of $1,000 to less than $10,000. However, for general purposes, I would say a mid-level donor is a regular donor, someone who gives to your annual fund, and someone you haven’t segmented out for a big gift. Most of the organizations I work with don’t have big development staffs, so they don’t have major donor silos like big organizations do. They still have big donors—just fewer of them. And even small and mid-size organizations direct too much of their focus on whoever they perceive to be their big donors.

Because my lenses are nearly always focused on legacy donors, I believe there is real value in cultivating, appreciating and engaging those people who are giving at less than a major gift level—whatever that is for your organization. That value will certainly pay off over time—and it could pay off in a big way if you engage them to the point of making your nonprofit the recipient of a legacy gift.

There are so many ways to engage these donors that the real problem is meeting them where they are. Some people want to dive in and “do something.” Others want to be reminded to give only that one time a year when they give to you. Some want a letter reminder. Others only want email. Some appreciate a phone call. Others will respond to a QR code or text link. Segmenting a database for how people want to give and when people want to give is a big job for a one-person development office who is probably also planning events, maybe writing a newsletter, handling all the different giving appeals through the year, staffing a development committee or maybe the board—and whatever else pops up under “other duties as assigned.”

To help development staff, let’s just try three simple ways to help your mid-level donors more strongly cement their relationship to you.

1. Develop a simple way to code donor contact preferences on individual donor records in your database in a format that will let you pull contact lists for each preference. Keep it to the ways you have available: newsletter, email, phone, text, in person, events, volunteering—whatever ways you have to engage and inform your donors.

2. When those codes are ready in your database, do a simple survey of your donors. Keep it short and focused on engagement. When the results come in, maybe 25% will have responded. Put that information into your database and use it.

What about the 75% who didn’t respond? That doesn’t mean they don’t love you. Maybe your survey arrived on a crushingly busy day and they never got back to it. Maybe they only read their email weekly. Keep contacting them in ways you have before unless they tell you to stop.

But let’s get back to the 25% who responded. Those people want to help you. They engaged with you. They told you how and when to reach them. Use that information and think of ways you can advance the relationship. Maybe they get a special invitation to coffee with the Executive Director. Maybe they get a special communication once a quarter. Maybe you invite them to participate in a program, tour a facility, participate in a focus group. As they engage more and you get to know them better, you will realize their special aptitudes and interests and be able to consider ways to put them to use for your mission.

3. In short, take the number of donors you think you can manage with all your other duties and work on a special cultivation plan for them, aimed at continuing financial participation and ultimately, leaving a legacy gift to your organization. Then work the plan as you have time and opportunity.

This presupposes you have a legacy giving program and a legacy society for stewarding them. If not, I’ll write more about that later.

For now, focus a bit more on the regular fish and ignore the whales. People do want to give. Their way of giving might not be what you are thinking of, but people generally are good and want to help if they can. Your mid-level donors have so much potential to support your mission. Do your best to foster those relationships so they grow into something fabulous. Learn to love your mid-level donors.

August is Make-A-Will Month

It’s July, heading toward August. It’s hotter than Hades (probably) in Phoenix, and those cool resolutions I made back in late December have gone by the wayside. How about your resolutions? I make the same resolution every year. That should tell you something. But I’d have to know you really well to tell you what it is.

One resolution I fulfilled a long time ago might have been on your 2024 resolution list: Make a will. And since August is Make-A-Will month, this might be a good time to revisit that thought.

During the pandemic, especially at the beginning, will-making flourished. People looked mortality in the face and realized it could sideswipe them and they got their affairs in order. Now. Not so much. A recent study of 2000 adult Americans indicated that 64% didn’t have a will in place. I was sad, but not surprised.

I hear all kinds of reasons why people think they don’t need a will – the very bedrock of estate planning. These reasons are wrong – or at least wrong-headed:

“I don’t have an estate” or “I’m not wealthy.” Everybody has an estate. And in Arizona, if everything you own is worth $75,000 or more, the Probate Court thinks you have an estate. Do you really want that aggravation and expense?

“I put my kids on the house, the car title, the bank account...” Shame on you! What happens if your kid gets sued? Your asset becomes an asset the kid also owns and it becomes fair game for payout in a losing lawsuit. Please don’t do that.

“It costs too much money.” It does cost money. And it’s money well spent. Your will directs exactly what you want done with everything you own when you’re gone. It gives you the flexibility to use those assets throughout your lifetime. It also gives you the opportunity to leave a legacy, not just with your family, but with the organizations you have valued throughout your life.

Those are just a few of the excuses I hear when I promote will-making. And one more thing: Don’t try to do it yourself. Yes, I know there is software online that claims to have all the answers. Have you ever tried to fix your car or a plumbing leak or an electrical problem and made the situation worse than if you had called in an expert in the first place? Making your will is not a DIY project. Please use an estate planning attorney in your state of legal residence to help you craft the document that directs your stuff exactly where, when and how you want it to go when you’re gone.

August is Make-A-Will Month. Just do it.

Planned Giving Myth #4. We Don’t Have Enough Wealthy Donors

Wealthy donors are great—especially if they love your nonprofit. And, hey, if they are your donor, you can expect that they at least “like” your nonprofit. When it comes to making a planned gift commitment, though, your organization may not rise to the top. I always want to be in their top three our four charitable organizations, because you are more likely to end up with a legacy commitment.

But back to wealth. Wealth is good. Wealthy people do make larger planned gifts, especially if those gifts are distributions from trusts. But let’s not overlook those donors who aren’t wealthy.

Giving USA 2021 reports that for 2020:

- Estimated bequests from estates $5 million or more amounted to $22.07 billion.

- Estimated bequests from estates with assets between $1 million and $5 million amounted to $8.61 billion.

- Estimated bequests from estates with assets less than $1 million amounted to $11.24 billion.

So, people with estates of $5 million or less made legacy gifts that nearly equaled the total legacy gifts of those with estates larger than $5 million. Especially since so much of household wealth these days is in real estate appreciation, that should be good news for most of us.

Instead of worrying about how wealthy your donors are, look for engagement and length of time of engagement. The longer they have been with you, the more likely they are to be committed.

An easy way to have that conversation is to ask them to endow their annual gift. If your endowment has a 4 percent spending policy, you can ask for 25 times their annual gift. In other words, a $25,000 legacy commitment for a $1,000 annual donor would produce a $1,000 gift. That is a consideration most of your faithful donors could entertain—whether you or they consider them "wealthy".

Wealth is nice, but it’s not your first consideration in building a planned giving program. Don’t let anyone tell you that your donors aren’t wealthy enough to make a legacy commitment.

My Kitchen Table Theory - March 25, 2021

I have a theory. It has not been quantified—although over time if could be. It has not been validated by double blind testing or any of those things the CDC likes to talk about. No scientific journals have asked to write about. So far as I know, no PhD student is making this research the basis for a thesis. It’s just something I have come to believe over time and over the years. I call it my “Kitchen Table Theory” and it goes like this: the closer I can get to sitting down with my prospective donor at his or her kitchen table, the more likely I am to gain a gift commitment. The farther I am from that kitchen table, the harder it is to get a commitment.

I rank gift conversation locations in order of likelihood of getting a commitment:

#1 Kitchen Table

#2 Dining Room Table

#3 Den or Family Room or Outdoor Entertainment Area

#4 Living Room

#5 My Office

#6 Donor’s Office

#7 Donor’s Club

#8 Coffee Shop or Restaurant

Let’s start with my favorite spot, the kitchen table. If I walk into a donor’s home and they ask me where I’d like to sit, I almost always suggest the kitchen table. In most homes, the kitchen is the heart of the home. Think about where people gravitate during a party. It’s always the kitchen, even if the food is in the dining room. The kitchen equals comfort and I want my donors comfortable.

When donors are comfortable, they are relaxed. When they are relaxed, they are open and more willing to talk. They are not distracted. Oh sure, the oven timer may go off or the dog may want out, but those distractions would take them farther away from you if you were somewhere else in the house. Even if they have to move stuff or pick up a place mat, the kitchen table is where I want to be.

The dining room table is almost as good. Especially if it’s a dining room table that is used for something other than holidays. I like being able to spread stuff out, give donors a surface for writing, give them a place to put their glass or cup or pen. The dining room table works well.

If I’m at a table and there is one donor with me in the conversation, I try to sit at a right angle. Knees could almost bump—and if they do, that’s fine. If I am talking to a couple, I will probably sit across from them. Otherwise, I’ll find myself talking more to the one closest to me. And with couples, it’s important to engage both of them—equally if possible.

The den, family room, or outdoor entertainment area have a couple of pitfalls for you to negotiate. Obviously, there is no convenient writing surface, so if there are papers to be filled out you will have to do it on your lap or briefcase. You may have to turn and make a real effort, depending upon the seating arrangement, of course, to equally engage both partners.

The other thing to be cognizant of in these areas is not to sit in the donor’s spot. They always have one. And for some reason, they almost always offer you THEIR recliner. I guess it’s just being a good host if they view their spot as the primo spot. Be aware of the remote, glasses, an opened book, the newspaper, a puzzle—something that indicates this spot is routinely occupied—and make an excuse to sit elsewhere. You want the donor in his spot. You want the donor to be comfortable.

If the living room looks perfect and unused, it’s going to be harder. The donor thinks of this as a formal space, not a comfortable daily usage space. It is still home and it is still better than anywhere that is not home, but it is removed from the heart of the home. Living rooms sometimes, however, have useful décor that makes it easier to start a conversation. Are there family photos, pictures from vacation, an evident collection or interest in art? The living room often showcases pieces like these that can be prompts for helping the donor relax and talk about something important.

Once you are outside of the home, meeting in your office may be seen as a neutral spot IF THE DONOR CHOOSES TO MEET THERE. Whenever possible, I let the donor set the meeting place. For a variety of reasons the donor might not want to meet in his home. The dog is a problem, they don’t want to pick up the house, they will be in your area for another meeting, etc. If they want to meet in your office, that is not a bad sign. It means they mean business—or are at least receptive to it. And it was their choice. Not bad. It’s still businessy and not home, but it’s not bad.

Outside the office and on the donor’s turf is not bad, but it’s also not good. If you meet in the donor’s office, if being joined by the donor’s partner, it’s not that second person’s turf. The person whose turf it is may be distracted by incoming calls, interruptions, etc. Partner #2 can feel a little unequal in this situation.

If you meet at the donor’s club, both partners are probably comfortable, but this can be very social with lots of interruptions and distractions looking at people arriving and departing. And they may tend to consider it more a social meeting than a business meeting. Ideally, the donor would be seated with his back to the room, but that almost never happens. At least the donor is in his element in his club.

A coffee shop or restaurant is a major distraction. There are ordering interruptions, drink refreshing interruptions. There may be social interruptions from other guests. It is a public space where you want to have a private conversation. It’s far from ideal—and yet I would bet about half of all the gift planning conversations with development staff take place in just such places.

I rarely contradict a donor’s choice of location, but I have been known to ask not to meet in one certain restaurant, which shall remain unnamed because it is so noisy, you cannot hear someone sitting across the table.

So that’s my Kitchen Table Theory. Heed it, ignore it, test it yourself. But I’ll bet you’ll find that the closer you get to the heart of the home the closer you will get to the heart of the donor. And that’s where gifts happen! Good luck!

Looking Forward - January 5, 2021

As I reflect on 2020, I find I don’t really want to. To appropriate a phrase from Judith Viorst and her character Alexander, it’s hard to think there are many for whom 2020 wasn’t a “no good, very bad” year.

As we put 2020 behind us and anticipate a time when everyone is vaccinated—and we can assemble and hug and shake hands and go to concerts and movies and maybe even lose the masks—some elements of 2021 will shape the future.

As Madame Judio tugs on her turban and gazes into her garden globe for inspiration, these are some of the reflections that occur (although it might just be the glorious Arizona sunshine):

Our work environment . . .

- There will be more working from home. Despite the hassles of not having everything that’s at the office and having to contend with the kids, the dog, and the doorbell, we found that we juggle pretty well and get our work done just as efficiently at home as we did in the office.

- Work attire will become even more casual—and not just on Fridays. Except for bankers and attorneys in big cities, Arizona had a fairly casual approach to work attire pre-pandemic. Post-pandemic, I predict leggings and yoga pants in the office and more polos than buttoned shirts for men.

- Commercial office space will downsize with more communal work spaces and fewer private offices. Why pay for the space if fewer people are there less often?

Nonprofits will get smarter . . .

- It will be a while before we have statistics on how many nonprofits didn’t make it. In the Great Recession, Arizona lost 10% of its nonprofits. A similar pandemic decrease would not surprise me.

- Social service organizations garnered vital support because they were serving record numbers of the hungry and the homeless. They gained new donors. Post-pandemic, they will need to keep them engaged and involved.

- Performing arts organizations, museums, and any organization dependent upon ticket revenues—despite You Tube and porch entertainment creativity —suffered mightily. The recently enacted Cares Act extension offers another round of Paycheck Protection Loans for organizations that can document a revenue drop of at least 25%. For most arts organizations, that won’t be a problem. I just wonder how many of the smaller ones have the wherewithal to make it through that second round of loan opportunity.

- Because the lessons of 2008 are a recent memory, coupled with the COVID debacle, I predict many organizations will take seriously the time-honored injunction to budget for at least six months of expenses as a reserve. The really smart organizations will move to build endowment.

- Nonprofits will have to do a better job of engaging and stewarding their volunteers. So many volunteer jobs vanished when everyone was dispersed, luring them back will not be as simple as opening the doors.

- Virtual meetings and events are probably here to stay. Why spend 45 minutes on the road from downtown Phoenix to Sun City when you can meet on Zoom? Some organizations gained participation from rural Arizona because they went virtual. Now they want to keep that participation. Some aspect of virtuality—if that is a word – will remain with us.

- As the giving gap widens between the really big donors and the rest of the world, nonprofits will have to work harder and smarter to retain their smaller donors. The smart ones will realize that many of those smaller donors are fantastic legacy prospects.

Either the sun has gone behind a cloud or Madame Judio is fading. It will be interesting to check back this summer or fall and see if her predictions are accurate. Fingers crossed that at least some of them are wrong—and hopeful that some are right. We don’t need another “no good, very bad” year.

Considering offering Charitable Gift Annuities? Here’s What You Need to Know

A Charitable Gift Annuity (CGA) is a life-income giving vehicle that offers the donor an immediate income tax deduction and income for life. It can be for one or two lives, and it can even be set up to defer the start of income payments.

It is both age-sensitive and interest-sensitive. The older the annuitant, the higher the rate of return to the donor. Most charities issuing CGAs use the rates recommended by the American Council on Gift Annuities (https://www.acga-web.org/). They review rates regularly and change them with a month or two warning.

Additionally, many organizations issuing CGA’s decline to offer them in all states. The state where the annuitant lives is the state that regulates gift annuities. There is no uniformity of regulation. Some states are virtually “anything goes.” In others, there are lengthy hoops to jump through, reserve funds that must be established, preliminaries and follow-up to be completed, in some cases, annually. Again, the American Council on Gift Annuities offers detailed information about each state’s regulations.

Most organizations that issue CGAs utilize software provided either by Crescendo or PG Calc. It is wise to have the donor complete an information form before preparing the gift annuity contract in order to have complete and correct information. Additionally, some states require specific language for disclosures that have to be provided to the donor. Because of the complexity in offering CGA’s to donors, most organizations who provide them are national charities or large, well-established local nonprofits like community foundations, hospitals and colleges.

Appreciated stock and cash are the two most frequently utilized funding options for CGAs. Using appreciated stock to fund a CGA allows the donor to bypass capital gain that would have been due if sold. CGAs may not be funded with Qualified Charitable Distributions from IRA’s. Most organizations will not accept real estate for funding CGA’s but there are some national organizations that will fund a CGA with a gift of real property.

Many organizations have an age minimum and a minimum funding amount. For an example, a CGA proposed for a 66 year-old grandmother and her 2-year old grandson would not be possible because the projection would not allow for the minimum 10% remainder required by law. If there are two annuitants, the closer they are in age, the better rate they can claim. The average age for a first CGA is in the mid-70’s.

And despite all of the above reasons, the main reason most organizations don’t offer CGA’s is that the entire assets of the organization have to be pledged to the annuitants. Even if the annuitants outlive their life expectancy and the fund is in the red, the organization is still obligated to pay the annuitant for life.

To summarize, here are the “con’s”— the reasons not to offer CGA’s:

- Obligation of the organization to pay the annuitant regardless of solvency of the CGA contract

- Need to invest in software

- State reporting requirements for issuing CGA’s

- Inability to administer and invest CGA’s

- Lack of expertise to issue annual 1099-R’s to annuitants

And here are the reasons why many organization’s do offer CGA’s – the “pro’s”: - People who get money from you, tend to love you. They do subsequent CGA’s and often become bequest donors. A CGA is often a gateway gift to the organization that leads to many other gifts.

- The ability to offer life-income gifts attracts a wide variety of donors to the organization who are susceptible to funding other types of projects.

- Organizations who are concerned about donors outliving the asset, have the opportunity to reinsure the annuity with a national commercial reinsurer.

Taking everything into account, a nonprofit that is successful and solvent, large enough to have a staff that can handle the investing and reporting on CGAs, and interested in growing their donor base should consider offering CGAs. Organizations with small staff and uncertain assets should look to local community foundations or national organizations to assist their donors who are interested in these life-income gifts.

Getting Naming Opportunities Right

8/25/2020

A former colleague reached out to pick my brain about naming opportunities. Having spent almost two decades at a university and watched us fumble a naming opportunity transition, I have fairly defined opinions about the do’s and don’ts of managing naming opportunities.

Most organizations first think about naming opportunities when they are building or renovating a facility. Occasionally an organization will approach it from an endowment standpoint. At what point is it worth the bookkeeping and reporting efforts to allow donors to name an endowment and segregate its use for a certain purpose? In the latter instance, I ask nonprofits to think about what the funds will be used for. That usually dictates a threshold dollar amount. For example, a $10,000 endowment with a four percent spending policy would generate $400 annually. Is that worth messing with? A $100,000 endowment would generate $4,000 annually. Depending upon the use for the fund, that might be worth messing with

Regardless of whether the naming gift will be used to build a facility, renovate a facility, name a program, or name an endowment the naming gift needs to be handled carefully.

Always start with a naming agreement. This is critical. A good naming agreement will be a legally enforceable document that has been prepared by the organization’s counsel and reviewed by the donor’s counsel. It should include these:

• Length of time the name will apply. For some athletics facilities, these are fairly short-term in the overall scheme of naming opportunities. An athletics facility is likely to carry a (usually a business) name for five to 20 years. Most naming opportunities, however, are designed to get a building out of the ground and the intention is that the naming will last for the “useful life” of the building.

What if the purpose for the building changes, but it is still being used? Let’s say the naming gift for the basketball arena was to last for the useful life of the building. Thirty years later, the university builds a new arena. The old arena is still in use—for PE classes and for practices.

In that instance, I would write the naming agreement so that if the purpose for which the naming agreement is made is transferred to a newer or different facility, the naming donor has first right of refusal to make the naming gift for the shiny new facility. All parties should be clear in advance that the new dollar amount will be significantly higher than the original dollar amount.

• How the naming gift will be received. Most organizations building something new need the money to build the building. Because of that, it would be unusual to let any but a small percentage of the money come from an estate gift. However, it is wise to have the agreement specify that if the donor dies before the pledge is fulfilled, the balance of the pledge will come from the estate. This is especially important if the organization feels a surviving spouse or children might not honor the pledge.

Many capital campaign pledges run for five years. Some organization will allow a donor to divide that pledge into sixths and let one-sixth of it come from the estate as an irrevocable pledge commitment that it can book.

• What are the “out” clauses? Usually it is the nonprofit that is concerned about a naming that might embarrass them if future activities or information comes to light that portrays the donor in a manner the nonprofit would not want to be associated with. Think of all the names the “Me Too” movement alone has turned up.

However, I can foresee that a donor might want to disassociate with an organization. Let’s say a nonprofit CEO is imprisoned for embezzlement or sexual offenses and the donor no longer wants the family name linked with the nonprofit. The out clause opportunity should benefit both parties. That said, I would encourage the nonprofit not to refund money given. The nonprofit will have already receipted a charitable contribution. I’m not an attorney or a CPA, but there should be a 1099 involved and maybe more if a gift were to be refunded. The nonprofit could remove the name, but keep the money. By the way, not fulfilling a pledge is a typical “out” for a nonprofit to remove a name.

• How and who might change the name? It’s much easier to address that in the gift agreement than to have a family member petition a nonprofit to add a spouse’s or a child’s name to an existing naming opportunity after the gifting donor is deceased.

• What variations of the name are allowable and when must they be used? This will sound like overkill only to someone who hasn’t taken a call from a donor family complaining that only the last name of the facility was referenced in an invitation or press release as opposed to the full name. Clearly a nonprofit cannot be responsible for how a media outlet refers to a facility, but they can and must adhere to the agreed upon naming conventions in their own publications, releases, social media and website.

I heartily recommend before any naming happens, the board have a candid discussion about what is eligible for naming and perhaps even minimum dollar amounts. For example, what if a board wanted to create a naming for a deceased founder? Over the years the founder, doubtless, supported the organization in many ways, including financially. But should it inspire naming something? There will have been in the past and in the future, others who have been significantly instrumental for the nonprofit. How can the organization establish clear criteria that don’t lean toward favoritism?

Another situation I have encountered is that an organization gets a really big bequest. Immediately, the organization wants to honor that individual with a naming. But you can’t do an agreement with a deceased person. And what would keep a future board from removing that name for the next big gift?

I’d have to say that, in general, I’m opposed to namings for deceased individuals initiated by boards in the absence of a naming agreement. I much prefer to see legacy gifts recognized through a heritage circle or legacy society or a Giving Tree in the lobby. It’s cleaner and keeps the organization from showing its biases. If everything is tied to living donors and dollar amounts, the agreement will keep the organization honest.

To recap, naming opportunities are finite and should be handled carefully in written agreements. During capital campaigns organizations do a better job of thinking through naming opportunities. Where an organization can step into a hole is when they start naming rooms and facilities for beloved deceased donors without clear criteria for the naming. Think carefully and draft a solid naming agreement before moving forward.

Some Giving Approaches You Can Use Right Now

8/5/2020

We are all six months into the pandemic now and our outlooks and outreach have changed. Early on—back in those days of innocence when we thought we would be seeing one another in person by now—we were mostly concerned with staying connected and how we looked in our home office for Zooming. Half a year (even though it feels like half a decade) later we are veterans of virtual meetings and keep our Zoom tops handy. My swimsuit coverup is on the couch behind me, ready to grab before my next meeting a few minutes away.

But as time progresses, PPP money has been spent, galas have been canceled or gone virtual, and nonprofits are having to make tough decisions on how and whether they can keep things going online. Here are some of my thoughts on sensitive ways to reach out to donors right now:

Start a $300 giving club. You will recall that the CARES Act allows donors for 2020 only (at this point) to deduct $300 above the line for a charitable gift. That amount is per tax return, not per individual. And—unlike almost every other charitable gift—the donor doesn’t have to itemize. The number of donors who itemize is down to about 10% because of a 2017 change in the tax code.

If you live in Arizona—as many of my blog followers do—I would start with those who give you Arizona state tax credit money. If they are maxing out their $400 (or $800 if married) household donations with your organization, you may be their favorite organization. If you live elsewhere, I’d start with my $500 or $1,000 donors. Those mid-range donors are—most importantly—donors. They already know you and like you. And it’s quite likely they aren’t itemizing their taxes and being able to claim charitable deductions any more.

Arrive at a pandemic use for your $300 club. Make it clear that it’s short-lived, not permanent. Use it to cover shortfalls in your budget, save a staff position, maintain a program—or whatever works for your organization.

Make a special connection with your QCD donors. Those donors are the ones who have been making a QCD—Qualified Charitable Distribution—gift from their IRA to save on income taxes. This year—in 2020—Congress has decreed that no one has to take money out of their IRA, so most people won’t. However, show your donors that you are knowledgeable and recognize that. Thank them for their past contributions from their IRA’s and let them know that other contributions are welcome.

Remember the stimulus checks that households with income of less than $150K got in the spring? Adults got up to $1,200 and households with kids got $500 for each kid. I am betting lots of folks socked that money away to see if it would be needed. If it hasn’t been needed several months later, maybe an appeal regarding how it could be used to benefit your mission might be successful.

Really think about this one and keep your ears tuned to Congress. Right now the House and the Senate are trying to work out the two trillion dollar difference in their recommendations for the next stimulus package. However, most pundits agree there will be some kind of household stimulus checks in whatever they iron out.

If you receive grants from Donor Advised Funds, be aware that grantmaking from DAFS is up significantly over a year ago. Donors who have created those funds to support charities are responding to the needs they see in their own communities with generous grant recommendations. Fidelity Charitable reports that for the first four months of 2020 grants to food pantries and food banks in the Southwest Region (Arizona, New Mexico, Oklahoma, and Texas) increased 735% over the same 2019 time frame. While human services and essentials are obvious needs in times of stress, those same donors have continued their regular support for their other nonprofits. Where there was a decrease in a sector, it was slight—no more than 3%.

And for your high income donors who might actually be able to use an income tax deduction, remember that there is a 2020-only special opportunity to deduct up to 100% of Adjusted Gross Income for cash contributions to public charities. There are wrinkles that will cause you to send them to their financial advisors for expert guidance. For example, if they have already given stock, that changes the formula. But because so many of the high dollar donors make their charitable contributions in the last quarter of the calendar year, now is the time to create awareness for those special donors.

We are living through an unprecedented experience. Not only do we have a healthcare crisis, we are facing a social justice crisis, a national election season, and seesawing financial markets. Keep talking to your donors and help them learn about these simple opportunities to support your mission.

Planned Giving Myth #3 - It Costs Too Much Money

6/4/2020

To the notion that it costs too much money to have a planned giving program, I say, “Codswallop!” The real cost to an organization’s not having a planned giving program is that those legacy commitments go elsewhere. Leaving money on the table or just handing it off to a more organized organization—now that’s a cost to consider!

But what does it really cost to start a program in planned giving? No matter how you slice and dice the budget, the real and potentially the only initial cost, is staff time.

We tend to forget how much staff time is spent on galas and other events and moan about staff time invested in planned giving. In my opinion (notice I did not say, “humble”), staff time would be much better invested in even a rudimentary planned giving program than in almost any event.

So, whose time does it take? There has to be a point person—preferably a staffer, but I have seen planned giving programs flourish in all-volunteer organizations, too. For the purpose of this article, however, let’s assume there is a small staff. Whoever is anointed point person should plan to spend a little time in self-education.

For those who live in urban areas, there is usually a planned giving council, a financial planning association, an estate planning organization—which may or may not accept a nonprofit credential for membership—and an Association of Fundraising Professionals Chapter. The last will have minimal programming on planned giving, but it’s worth keeping an eye on it. Additionally, many universities these days have programs in nonprofit management, which may or may not have at least one class on planned giving.

The online world is filled with opportunities, however, for self-education—much of it free or reasonably priced. Both Crescendo and Stelter—companies that sell or sync with planned giving software—offer seminars, literature, and often have free resources on their website. With Crescendo, a student can go through the coursework in their eCollege and earn a Certified Gift Planning certification. And other organizations like MarketSmart and Bloomerang offer webinars. Lots of opportunities for self-education.

Perhaps as important as education is networking. All the above-named resources are organizations filled with folks who speak gift planning. It really isn’t necessary to be a guru yourself—you just need to be able to reach out to your own connections when you need advice or a simple answer.

There is other staff time involved as well. The leadership team—whether staff, board, or some combination—will need to review the organization’s gift acceptance policies and tweak them for planned gifts. There will need to be discussions with finance about what can and cannot be booked and, if endowed, how to invest and custody those funds appropriately. Being clear about how to recognize planned gift donors will save hassle and heartache later. I recommend a legacy society separate from however you recognize your annual fund major donors. The data team may need to be involved in surfacing prospects. The website will need an update about your planned giving program. And you’ll want to announce it on social media, too. Even the receptionist needs to be aware that a call asking for your EIN needs to be reported to someone for followup.

As the logically visible prospects are contacted, they will guide you toward your first expenditures other than staff time. Would they like a private briefing from the President, an insider tour, a chance to meet over coffee, a lapel pin? Do you need a brochure? Is there a mailing in your future? They will guide you toward your first non-staff expenditures.

But it still isn’t much. The organization will have spent a small amount for professional memberships and meetings, maybe reimbursing for coffees or lunches, eventually for smaller expenditures surrounding donor stewardship and recognition. It certainly isn’t enough outlay to use the cost of implementing a planned giving program as an excuse. It’s just a myth that you have to spend money to have a planned giving program. Don’t buy into that fiction.

COVID Changes Giving

5/6/2020

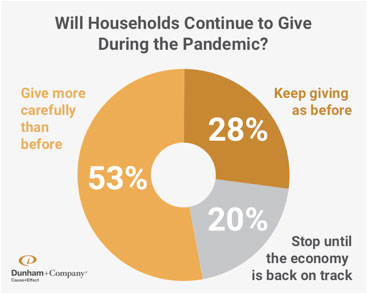

An April study commissioned by Dunham + Company (https://www.dunhamandcompany.com/fundraising-research/donor-confidence-strong-in-the-face-of-covid-19/) offers insights into the immediate future of fundraising. A broad spectrum of more than 600 2019 donors who made gifts ranging from $20 to $66,500 were surveyed about their future charitable gifts. Although a slight majority (53%) indicate they plan to continue giving, they will do so with greater thought and care than pre-COVID. An additional 28% will continue their giving unchanged. But the worrisome segment is the 20% who will have to stop giving until the economy gets back on track for them.

Here is a graph from the study:

“After one month of shutdown, 10 percent of donors overall expect to give less because of either the pandemic or the economy in general, which is a direct result of the pandemic,” said Rick Dunham, CEO of Dunham+Company, a global fundraising and marketing consulting firm to the nonprofit sector.

One in four households are feeling the financial effects of the epidemic, making it difficult to meet their regular and charitable commitments.

Age is a factor in household giving, with Boomer and older donors indicating they would continue giving, while Millennials indicated they might give less. “It’s instructive, however, that this percentage is significantly lower for Boomers and older donors at just 6 percent, which are key giving demographics,” according to Dunham. For example, 66% of Boomers versus 40% of Millennials indicated their future giving was likely to increase or stay the same

And in good news for the future, 60% of households surveyed indicated that nonprofits are doing a good or excellent job. That faith should be repaid with dollars when the economy allows.

Planned Giving Excuse #2 - It’s Too Technical

5/4/2020

To that notion, I say—“Balderdash!”

Planned giving CAN be technical—if you want it to be. But it doesn’t have to be technical. Sure you can go around flinging down your CRUTs and CRATs and bemoaning the 7520 rate. And how many of your donors will have a clue what you’re talking about? None. Or next to none.

Again, echoing the advice of my planned giving guru Dr. Russell James, “use family words.” Remember how you learned that by being included in someone’s estate plan you were being made family? Think of talking about planned giving like you were talking to your grandmother

First, the term “planned giving” is suspect. In Canada, for a long time, it’s been the Canadian Association of Gift Planners. CAGP got it right while south of the border the US stumbled from being a “national committee” to a PPP and finally to the National Association of Charitable Gift Planners.

Dr. James did a study, “Testing the Effectiveness of Fundraiser Job Titles in Charitable Bequest and Complex Gift Planning.” Guess what? Most people didn’t understand the term “planned giving.” Job title info is both interesting and enlightening.

Second, anything that sounds like legalese is off-putting. Speak in simple English. You don’t want to sound like their attorney. You’re not their attorney. Even if you are an attorney, if you’re representing a nonprofit, you’re not THEIR attorney.

Most planned gifts your organization will receive arrive via bequest in a will or a distribution from a trust. Studies vary from 60-90% of planned gifts coming in that simplest of fashions. If you simply ask people to remember you in their wills—even if they have a trust or other form of estate plan—they understand what you mean. Your grandma understands what you mean. And in Dr. James’s study, the response for a request to make a bequest netted a 12% favorable response versus 23% who would consider making a gift in their will.

If you can talk to donors about why they might want to consider leaving something to your organization in their will that will continue their legacy, that’s what you need to be able to talk about. Ask someone to “send” not “submit”; request a “gift” not a “transfer of assets.”

Avoid death words. People want to be remembered, have their stories remembered, leave a legacy. Yes, they understand that they will be gone when it happens, but we don’t have to throw that in their faces. There’s no need to get into TOD and POD transfers to be successful in talking about planned giving.

Let your donors tell their stories—how easy it was to include your organization when they updated their will; why they decided to use stock this year for their annual gift; how they didn’t need all of that QCD and giving your nonprofit part of it saved on taxes. Their stories, their words—have impact with other donors and will not be technical.

So, if you can talk to your grandma about making a gift in her will to your nonprofit, you have all the necessary language to help your donors consider planned gifts and share their stories. Planned giving does not have to be technical. In fact, it is detrimental to make it so. Another excuse busted!

Planned Giving Excuse #1 - It Will Hurt the Annual Fund

4/27/2020

To that sentiment—voiced often by EDs and CFOs— may I say, “poppycock!”

The annual fund, in most organizations, is the driver of the budget. Development officers are pressured to make their goals. The annual fund keeps the wheels on and going around.

Many misguided nonprofit leaders fear planned giving and the often resulting endowment obligations for the organization. But saving that rabbit hole for another day, let me explain why the misguided believe it will hurt the annual fund.

That notion is a miscalculation on human nature. If people value your organization enough to put you in their will, name you as a beneficiary of their trust, give you their IRA, etc.—they have made you family. You are an honorary member of their tribe. They are not going to downsize their annual gift.

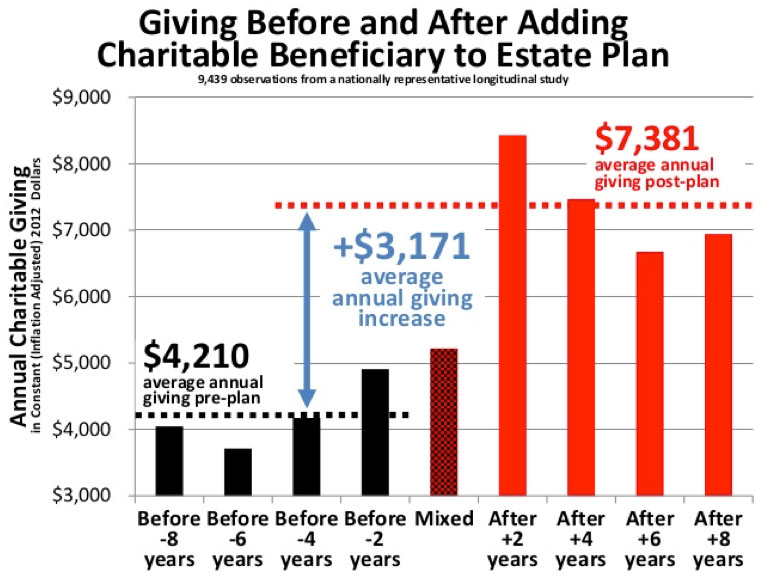

And it’s not just me that thinks that. Research bears that out. My planned giving hero is Dr. Russell James at Texas A&M. If you don’t know his work, go look him up.

His research clearly shows the pattern of what happens with donors who make legacy commitments. In my former organization, we called this the “tattoo slide.” I used it so often my colleague stated that if I were ever to get a tattoo, it would be this slide. And when they had my going away party, they put the slide on labels and stuck one on everyone coming in the door. But I digress.

Dr. James’s study was conducted nationally over a 16-year period. It involved approximately 10,000 donors with legacy commitments. The study showed that in the two years before they named the charity in an estate plan, donors’ annual gifts went up considerably. It didn’t quite double as they pondered including you in the family. Then for two years after they did the deed, there was exuberance. Their annual gift did double from before you were in the will. After that first two-year period of being in the will, their annual gifts dropped some, but never to the level of before you were in the will. Why would it? They have invested in your organization with the assets of their lifetime. They want you to succeed. You are family.

Asking someone for a planned gift or an endowment gift does not hurt the annual fund. It’s quite the opposite in fact. Your organizational leaders who fear planned giving are not only wrong—they are hurting the organization’s future by not seeking planned gifts. It is a baseless fear and a misguided notion that planned gifts hurt the annual fund. That’s a bad excuse for not having a planned giving program.

Will Your Nonprofit Survive?

2/10/2020

My apologies if you missed the disco era, but Gloria Gaynor’s “I Will Survive” keeps popping into my head. She was singing about overcoming lost love. As nonprofits, we have a lot to overcome now and in the weeks (hopefully, not months) ahead.

As recently as late February, projections were that nonprofits might see a 4% bump in revenues in 2020—if the market held. We all know that the economy destabilized and we have a reverse situation now.

Monday’s Nonprofit Times reports on a study conducted in late March of more than 500 organizations globally by the Charities Aid Foundation of America. Approximately one-third were in North America. In the survey, 97% of nonprofits indicated they have been negatively affected by COVID-19. Only 10 organizations reported no ill effects.

And the scary news is that 10% have already closed and suspended operations. Some of those, of course, are schools and churches, which will be back in business when the pandemic abates. All of of them won’t be back, though, and we will lose more as time progresses.

You can link to the report here: https://www.cafamerica.org/covid19report/

Decreasing contributions from donors, schedule disruptions (travel, events), and inability to reach donors were the primary concerns, followed closely with increasing demand for services. Almost two-thirds of organizations are now working remotely and only 28% say they are fully operating.

Here are some of the distractors nonprofits are facing:

• 88% have canceled major events

• 72% have halted business travel

• 2/3 have shifted their short-term goals and reduced costs

If there are any silver linings here, it may be that two-thirds of nonprofits are researching innovations to help them keep operating. For example, those who can manage programming online have shifted the emphasis there—but organizations that are heavily dependent upon volunteers for delivering services are hurting.

And there are resources out there for nonprofits through local grants and some of the recent provisions of the CARE Act.

It is still to early in the game to draw parallels to 2008/2009, but some will likely apply. In Arizona, we lost 10% of Arizona nonprofits in the Great Recession. How many will we lose in whatever we end up calling this event?

Those who are nimble. Those who have looked beyond their current budget. Those who are fully embracing their mission. Those with reserves. Those nonprofits will survive.

Good News Bad News

4/1/2020

The CARES Act (Coronavirus, Aid, Relief, and Economic Security Act), which passed into law on March 27, has some limited provisions that may make a difference in how nonprofits fundraise from their donors this year. And as with most legislation, it can be a good news/bad news scenario.

Let’s have the good news first. For your smaller, cash donors, there is some good news. Section 2104 of the new law takes into account that since 2018 the number of Americans who can benefit from a charitable income tax deduction has dropped to about 10% of taxpayers. For those non-itemizers, who make a cash gift of $300, they can deduct it above the line on the 2020 tax return. In essence, that means it comes off the top and effectively reduces their taxable income by $300.

This applies only to non-itemizers and only to cash gifts. And as far as I can tell, right now it applies only to 2020 income taxes. Additionally, I would caution you to make it clear to your donors that this is ONE $300 deduction for the year. It is NOT a $300 deduction to multiple charities.

If I were an annual fund manager, I would be looking though my donors and appealing to receive their $300 gift. Maybe you start a 300 club and send them a static cling for their car window. Those things cost pennies. And I would be doing it yesterday. They only get one $300 deduction. Make it their gift to your mission. Start with your appropriate donors who haven’t given yet in 2020 and appeal to them. Then, go back and try for an upgrade of your $50-on-up donors to get an additional gift to put them into the 300 Club. To strengthen your appeal think of some tangible impacts of a $300 gift for your mission.

Notice that this is not a ploy for the major gift officer. Major gift officers are dealing with the itemizers. This deduction does not apply to them. The legislation clearly clarifies: “The term ‘eligible taxpayer’ means any individual who does not elect to itemize deductions.” And the usual restrictions apply. It must go to a qualified charity, not a supporting organization or donor advised fund.

But, major gift officers should be aware that itemizers can deduct up to 100% of their adjusted gross income for CASH gifts to qualified charities—not stock, not real estate—cash. You will recall that the Tax Cut and Jobs Act changed the ceiling for gifts to charities from 50% to 60% of AGI. Some of your major donors might utilize that deduction. Good news for those donors and their MGOs.

There are other provisions that are advantageous to nonprofits, but that isn’t for this entry. You can get the full text of the act here: https://www.congress.gov/bill/116th-congress/senate-bill/3548/text

Now for the not-so-good news. Let’s set the stage: Congress, way back in 2015, finally made what we used to call the “IRA rollover” a permanent giving opportunity for our donors aged 70.5 and older who had to take a required minimum distribution (RMD) from their traditional IRAs.

Smart charities have been educating their older donors to give their annual gifts through what we now call the Qualified Charitable Distribution (QCD). The benefit to the donors is that they don’t have to pay income tax on those QCDs—although, of course, there is no charitable contribution deduction. But most of those donors couldn’t itemize anyway.

Now that some organizations have diligently sought and nourished those donors and trained them to give through their IRAs, it appears that there are no RMDs required in 2020. We were thrown a curve in December when the SECURE Act was signed into law. It said that anyone who wasn’t already 70.5 by December 31, 2019 could wait until they were 72 to take their RMDs.